This system is not just about money; it’s about ethics, fairness, and the avoidance of exploitation. It’s a fascinating blend of finance and morality, creating a compelling topic for those interested in exploring new perspectives on debt.

So, whether you’re a financial whiz, a curious reader, or someone interested in Islamic teachings, this article will provide a clear and concise understanding of Sindiran Hutang Islami. Dive in and uncover the principles that make this approach to debt unique and intriguing.

Sindiran Hutang Islami

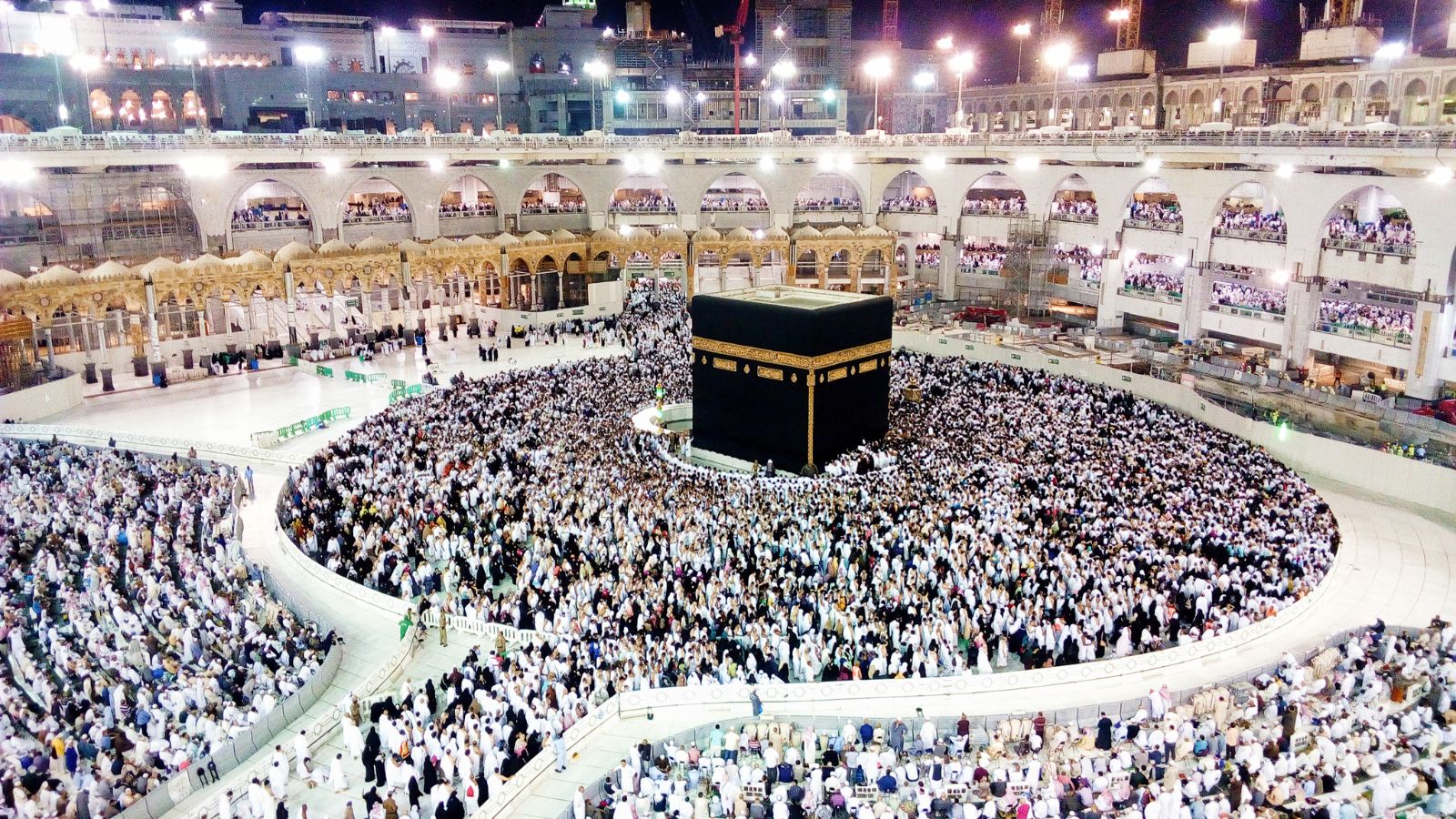

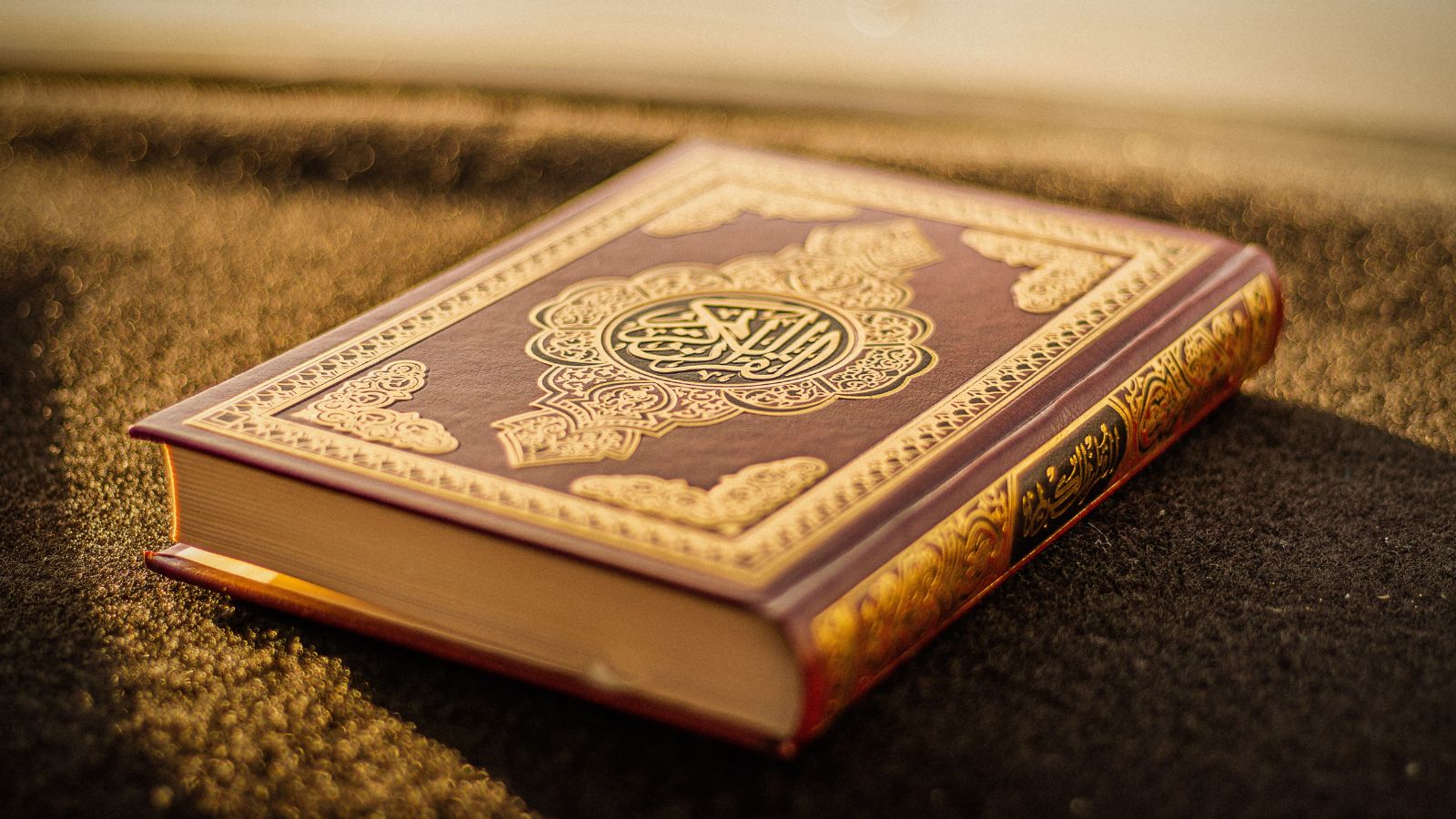

Sindiran Hutang Islami represents an innovative way of handling debt based on Islamic principles. This system integrates ethics, fairness, and a strong aversion to exploitation. Those principles serve as its backbone and define its operations. For example, it prohibits charging interest, known as “Riba” in Islamic law, as it considers the practice exploitative.

Sindiran Hutang Islami prioritizes shared responsibility and risk over profits. There’s a collaborative approach to handling debts. Debtholders may opt for “Musharaka,” a partnership where both parties share the profits and losses. Or go for “Murabaha,” where a commodity is sold at a profit, with the profit margin disclosed upfront. In both cases, neither party bears the burden solely.

Several institutions globally practice this form of debt management. These include banks, non-banking finance corporations, and microfinance institutions. They’ve seen successful operations, with reports citing a high recovery rate of loans, attributed to the debtor-friendly policies and system’s inherent fairness.

Overall, Sindiran Hutang Islami offers an equitable alternative to conventional debt handling systems. It modifies the power dynamics inherent in traditional debt relationships, striving for a win-win situation for all parties involved.

Comparison between Sindiran Hutang Islami and Conventional Loans

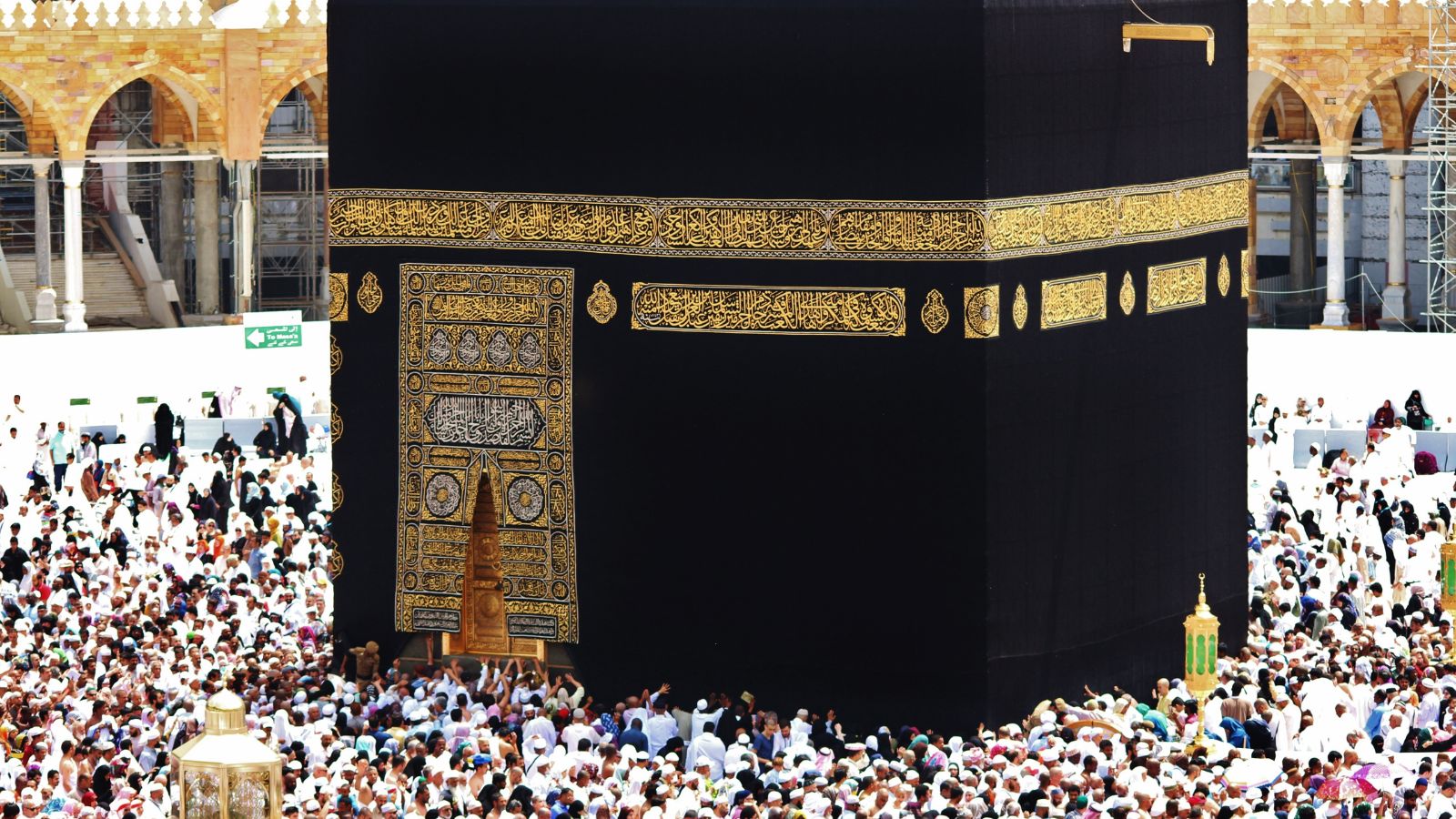

In probing the differences, one understands why Sindiran Hutang Islami attracts many businesses and individuals. Unlike conventional loans, it eliminates the concept of interest, safeguarding the debtor from excessive financial burden. This principle paints a stark contrast to the interest system utilized in traditional loans, typically leading to a spiraling debt for the borrower.

The equitable mindset of Sindiran Hutang Islami goes further. This system allocates wealth based on merit and feasibility of business ventures, not just collateral securities. In more commonplace loans, however, the borrower’s capacity to provide collateral usually determines loan approval, often excluding those with less to secure.

Lastly, loan recovery rates for Sindiran Hutang Islami attribute to its debtor-friendly policies. Standards are determined by the debtor’s financial ability, thereby ensuring affordability. Traditional loans, however, maintain set strict recovery rules, often leading to financial distress for borrowers.

To summarize, Sindiran Hutang Islami embodies a compassionate, equitable approach, emphasizing ethical practices, shared risk, and the empowerment of borrowers, thus emerging as a viable alternative to traditional loans.

Sindiran Hutang Islami Process

The Sindiran Hutang Islami process is distinct, founded on principles of fairness and shared responsibility. Unlike conventional loan processes, debtors and lenders jointly shoulder the risk in Islamic debt. This principle, rooted in Shariah law, encourages ethical business practices by dividing losses and gains between debtor and creditor.

Secondly, the risk-sharing element compels creditors to scrutinize their investments carefully, promoting fiscal responsibility and discouraging reckless lending practices. For example, in a Musharaka (joint venture) contract, lenders bear a portion of the financial loss if the venture fails, fostering a mutual interest in the project’s success.

Thirdly, the funds are invested in ethical, halal businesses. The investments exclude companies dealing in haraam (prohibited) sectors like pork, alcohol, gambling, or weapons. This vital difference prioritizes ethical considerations over profit maximization.

In sum, the Sindiran Hutang Islami process differs from traditional loan processes in its emphasis on shared risk, ethical investments, and debtor benevolence. Predictably, these elements have contributed to the high recovery rate of loans in Sindiran Hutang Islami globally. The model embodies a compassionate, equitable, and ethical approach to debt, offering a potential model for future financial systems worldwide.

Benefits of Sindiran Hutang Islami

Sindiran Hutang Islami’s benefits extend beyond the ethical principles at its core. It harnesses some inherent business strengths, leading to economic stability and resilience. First on the list, transparency prevails in Sindiran Hutang Islami. Every debt transaction consists of formal contracts that outline clear terms for profit and risk sharing. Transparency not only insists on accountable actions but fosters trust among the parties involved.

Thirdly, Sindiran Hutang Islami focuses on shared risk. Unlike traditional lenders, a practicing Islamic establishment takes the piping hot risk biscuit along with the debtor. This factor eases the risk pressure on the borrowing entity, paving the way for fair, less stressful cooperation.

In addition, borrower compassion provides a unique perk in the Sindiran Hutang Islami method. Lenders, in case of a borrower’s financial distress, show leniency, recognizing the shared responsibility and risk involved. This approach encourages financial stability and reduces the magnitude and frequency of debt crises.

The impressive global loan recovery rates in Sindiran Hutang Islami highlight its practical benefits. A financial system that promotes compassion, ethics, and shared responsibility demonstrates the potential to inspire future economic models. It’s an illustration of what’s achievable when finance meets ethics, societal value, and humane treatment of stakeholders.

Sindiran Hutang Islami doesn’t just represent a debt handling model; it’s a banner of an ethical economic system that instills fairness and kindness in financial relationships for generations to come.

Limitations and Challenges of Sindiran Hutang Islami

Despite its profound benefits and universal appeal, Sindiran Hutang Islami isn’t free from limitations and challenges. A pervasive limitation is its extensive reliance on trust and shared risk, potentially resulting in moral hazards. Indeed, borrowers might exploit these principles, defaulting on loans without real consequences. For instance, Ethiopia’s Islamic Microfinance faced a ballooned 20% non-repayment rate in 2017.

Public awareness also proves to be a hurdle. Since it’s a relatively novel concept outside Islamic countries, many potential borrowers remain unaware of its benefits and principles. For instance, in India, where more than 200 million Muslims reside, not many practice Islamic banking. A 2019 FICCI report cited awareness as a crucial growth impediment.

Lastly, many traditional investors often find Sindiran Hutang Islami’s profit and loss sharing principle unsettling. Primarily, it’s because the scheme doesn’t guarantee fixed returns or capital protection, as per the principle of Musyarakah (profit sharing). As a result, it becomes a hindrance to attracting large investors.

Hence, while Sindiran Hutang Islami carries the promise of an ethical financial system, it faces several hurdles in terms of trust, scalability, public awareness, regulation, and investor attraction. Overcoming these challenges remains a priority for anyone looking to mainstream this system worldwide.

Case Studies of Sindiran Hutang Islami

Case studies often shed light on practical scenarios, and it’s no different for Sindiran Hutang Islami. They illustrate its successful application in diverse geographical and economic contexts, showcasing its practicality and effectiveness.

Secondly, let’s explore its usage in Indonesia. The world’s largest Muslim-majority country exhibited low default rates, with Sindiran Hutang Islami based small-business loans. Notably, this occurrence correlated with the relationship-focused lending approach that considers a borrower’s character when extending loans.

Doha in Qatar’s third case paints an interesting picture. Here, many large-scale infrastructure projects got funded by the system. These investments, free from unethical industries, underscore its potential as a vehicle for responsible economic development.

Sindiran Hutang Islami stands as a beacon of ethical finance. It’s a system that has proven its mettle across various global contexts, from Malaysia to the United Kingdom. Its high recovery rates, low default rates, and ethical investment practices speak volumes about its effectiveness. However, it’s not without its challenges. Greater public awareness, simplified regulatory procedures, and wider acceptance of its profit-sharing principles are key to unlocking its full potential. It’s clear that Sindiran Hutang Islami holds the promise of a fairer, more compassionate financial future. Yet, it’s up to us to embrace this system and work towards overcoming the obstacles in its path. In doing so, we’ll not only be adhering to Islamic principles but also promoting a more equitable and ethical financial world.

More Stories

Embrace the Thrill of Crash and Slot Games from Home

Withdrawal Methods in BC.Game

Home Design for Coastal Luxury: 4 Ways to Acclimate to the Surroundings